Nvidia Begins Post-Stock-Split Era With Price-Target Hikes

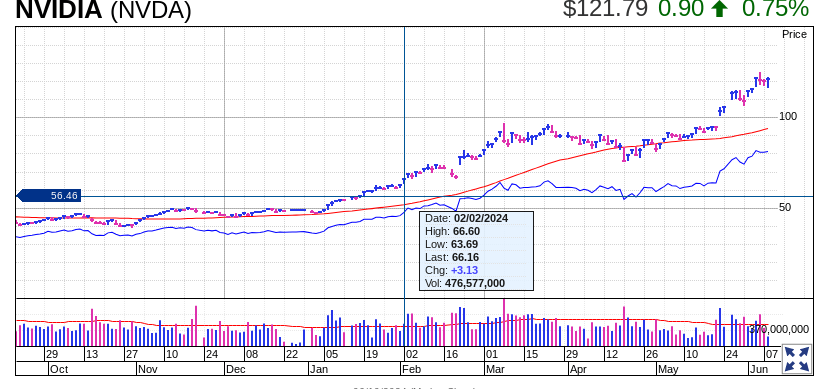

AI chipmaker Nvidia ( NVDA ) on Monday began trading after its 10-for-1 stock split and received price-target hikes from three Wall Street analysts. Nvidia stock rose on the news.

Investor’s Business Daily3-4 mins 11/06/2024

Robots of all sizes and shapes are a major component of a variety of industries.

Barclays, Susquehanna and TD Cowen raised their price goals on the leading graphics chip.

Barclays Analyst Tom O’Malley raised his price goal for Nvidia stock to 145, up from a split-adjusted price of 120. He repeated his buy, or overweight rating on Nvidia.

The price increase is a reflection of the incremental sales opportunities for Nvidia from countries that purchase their AI chip, O’Malley declared in the client letter. He believes that this particular market will be growing significantly over the next year.

Today, on the market this morning, Nvidia stock advanced 0.8 percent to close at 121.79.

No ‘Air Pocket’ In Sales Expected

Susquehanna Financial Group analyst Christopher Rolland increased his price target of Nvidia stock to 120 from 145 on a split-adjusted base. He maintained his high rating regarding Nvidia shares.

Supply chain checks show that there is no issue transitioning towards Nvidia’s new B100 AI processors for data centers during the second part 2024, he added.

Certain investors have expressed concern about the possibility of an “air pocket” in sales when customers switch to Hopper models of graphics processing and onto next-generation Blackwell series graphics processing units, Rolland said.

“We and many investors have been fearful of an ‘air pocket’ in the transition from Hopper to Blackwell,” Rolland stated in a letter to clients. “Discussions and general checks across the supply chain dispel our worries and are providing us with confidence for an ongoing and smooth transition.

TD Cowen analyst Matthew Ramsay has maintained his buy rating for Nvidia stock, and raised his price target to 140 instead of 120.

“Reiterating our thesis, we see Nvidia as the leader in accelerated computing,” Ramsay stated.

AMD Stock Downgraded

In addition, Nvidia rival Advanced Micro Devices ( AMD) has seen its shares drop on Monday due to the downgrade of its stock rating.

Morgan Stanley analyst Joseph Moore reduced his rating for AMD the stock down to an equal amount, a step up from overweight. However, he kept his price target at 176.

The following Monday AMD stocks fell 4.5 percent, closing at 160.34.

“We like the AMD story, but investor expectations for the AI business still seem too high to us,” Moore stated in a note to clients. “We see limited upward revision potential for AI from here.”

Nvidia Stock On Five IBD Lists

Nvidia stocks as well AMD shares are listed on the IBD leaderboard..

Furthermore, Nvidia is on several other IBD lists, including: IBD 50, Big Cap 20, Sector Leaders and Tech Leaders.

Additionally, Nvidia stock is one of the Magnificent Seven stocks..

You can follow Patrick Seitz on X, before Twitter @IBD_PSeitz. @IBD_PSeitz to read more about software, technology for consumers and semiconductor shares.